Comprehensive Guide to the Best Crypto Analysis Tools for Investors and Traders

The cryptocurrency market is known for its volatility and rapid changes. This often makes trading and investing a daunting task for many individuals. To navigate this complex landscape, investors and traders require reliable analysis tools. In this comprehensive guide, we will explore the best crypto analysis tools available, their features, and how they can assist you in making informed decisions.

As an investor or trader in the crypto space, understanding market trends and price movements is crucial. Crypto analysis tools provide insights into market behavior, helping traders develop effective strategies. They offer technical analysis, fundamental analysis, sentiment analysis, and more. By utilizing these tools, you can enhance your decision-making process and potentially increase your profitability.

Technical analysis is the study of past market data to forecast future price movements. It relies on various metrics and indicators. Some popular technical analysis tools include:

TradingView

TradingView is one of the most popular platforms for charting and analyzing cryptocurrencies. It offers a range of features, including customizable charts, technical indicators, and social networking capabilities for traders.

Coinigy

Coinigy is another powerful tool that connects to multiple cryptocurrency exchanges. It allows traders to access real-time data and charts, automate trading, and even manage assets across different exchanges.

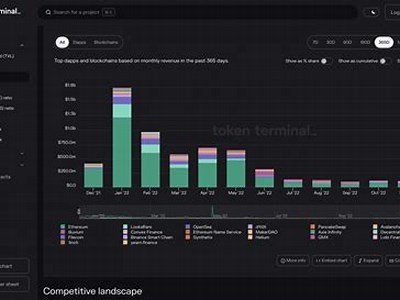

Fundamental analysis involves evaluating a cryptocurrency's value based on various economic and financial factors. Key tools for fundamental analysis include: -

CoinMarketCap

CoinMarketCap provides crucial data on market capitalization, trading volume, and historical data for different cryptocurrencies. It is a valuable resource for assessing the overall health of the market. -

Glassnode

Glassnode provides on-chain data and insights about various cryptocurrencies. It helps investors understand the underlying factors that influence price movements through metrics like active addresses, network growth, and HODL waves. Sentiment Analysis Tools

Sentiment analysis gauges market participants' emotions and opinions about a particular cryptocurrency. Effective sentiment analysis tools include: -

CryptoFear&Greed Index

This index tracks market sentiment by measuring various factors, such as volatility and social media trends. It provides a quick overview of whether the market is in a state of fear or greed. -

Social Media Sentiment Tracker

Tools like LunarCRUSH analyze social media platforms for sentiment related to particular cryptocurrencies. They aggregate social media discussions, influencer opinions, and trends to provide insights into market sentiment. Comprehensive Analysis Platforms CoinGecko

CoinGecko is a comprehensive cryptocurrency data aggregator that provides information on price, trading volume, and various other metrics for thousands of cryptocurrencies. It offers a user-friendly interface, making it easy for beginners and advanced users alike to find what they need. Messari

Messari is a platform that provides in-depth analysis, research, and real-time data on various cryptocurrencies. It offers a suite of tools for investors and traders, including market insights, executive summaries, and live pricing data. Algorithmic Trading Tools

Algorithmic trading refers to using automated systems to execute trades based on predefined criteria. Some popular algorithmic trading platforms include: -

3Commas

3Commas enables users to create automated trading bots that can execute trades based on specific strategies across multiple exchanges. -

HaasOnline

HaasOnline is a powerful trading bot platform that offers sophisticated tools for building and backtesting trading strategies. Risk Management Tools

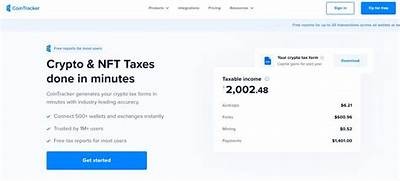

Effective risk management is vital for success in cryptocurrency trading. Here are some risk management tools to consider: -

Crypto Pro

This app provides portfolio tracking and detailed analytics to help investors manage their risks effectively. -

Delta

Delta is a portfolio management tool that allows users to track their investments across various exchanges, providing insights into performance and risk exposure. Conclusion

Investing and trading in cryptocurrencies can be complex and risky. However, with the right analysis tools, you can gain a deeper understanding of market dynamics and make more informed decisions. Whether you prefer technical analysis, fundamental analysis, or sentiment analysis, there is a wide variety of tools at your disposal. Engaging with these tools can sharpen your trading strategies and lead to more profitable outcomes. Related Tags