Ethena Crypto Price Prediction for 2024: Insights and Market Analysis

As the cryptocurrency market continues to evolve, many investors are keenly interested in predicting the future prices of digital assets. Ethena, a relatively new player in the space, has garnered significant attention due to its unique technology and underlying utility. This article provides a comprehensive market analysis and price prediction for Ethena in 2024, helping investors and enthusiasts make informed decisions.

Ethena is a blockchain-based platform designed to facilitate decentralized applications (dApps) and smart contracts. Leveraging advanced cryptographic techniques, Ethena aims to provide a secure and scalable network for developers and users alike. The native currency, ETHN, plays a pivotal role in the ecosystem, enabling transactions, governance, and incentivizing participation.

The cryptocurrency market is influenced by various factors, including technological advancements, regulatory developments, and macroeconomic conditions. In 2024, we anticipate several trends that could impact the pricing of Ethena:

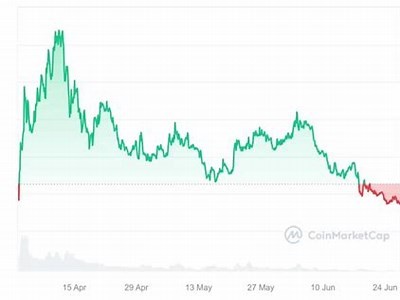

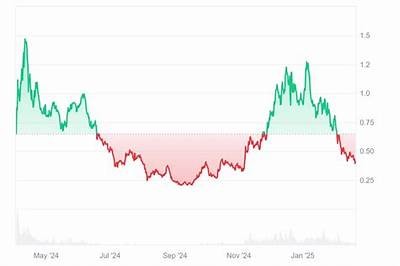

To forecast Ethena's price for 2024, we employ a combination of technical analysis, market sentiment, and fundamental analysis. Technical indicators such as moving averages, relative strength index (RSI), and historical price patterns will guide our predictions. Simultaneously, we will also consider the general market sentiment towards cryptocurrencies as expressed through social media trends and overall trading volume.

Analyzing current and historical price charts can provide valuable insights into potential future movements. As of late 2023, ETHN has shown a bullish trend, with key resistance levels established at $1.50 and $2.00. If the asset breaks these levels, it could indicate a stronger upward momentum.

Additionally, the support levels around $1.00 and $0.75 suggest that any significant price drop would likely find buyers, indicating healthy market interest in Ethena. Market Sentiment and Investor Behavior

The sentiment in the crypto community can greatly influence price movements. Currently, there is a growing enthusiasm for Ethena, fueled by its innovative approach to dApp development. Social media platforms and cryptocurrency forums indicate a bullish outlook among retail investors, which typically correlates with price increases. Fundamental Analysis: Evaluating Ethena’s Value Proposition

Ethena's value proposition lies in its utility as a platform for developers. By offering lower transaction fees and faster processing times compared to its competitors, Ethena may carve out a significant market share. Its partnerships with various blockchain projects also enhance its credibility and market position. Economic Factors Affecting Ethena’s Price

In 2024, several economic factors could play a role in influencing Ethena’s price: 1. **Global Economic Conditions**: Fluctuations in traditional financial markets can lead investors to seek refuge in cryptocurrencies, potentially driving up prices. 2. **Inflation Rates**: High inflation rates may prompt individuals to invest in crypto as a hedge against currency devaluation. 3. **Technological Adoption Rates**: The more businesses and individuals adopt blockchain technology, the more demand there will be for Ethereum-based projects like Ethena. Potential Risks and Challenges

No investment comes without risks. Ethena faces challenges such as regulatory scrutiny, technological competition, and market volatility. A sudden market downturn could significantly impact Ethena’s growth, even if its fundamentals remain strong. Conclusion

As we look ahead to 2024, Ethena presents a compelling investment opportunity. With a solid technological foundation, increasing market adoption, and positive investor sentiment, ETHN could see significant price increases. However, potential investors should remain vigilant and consider both the opportunities and risks associated with this emerging cryptocurrency. Final Thoughts

While price predictions should be approached with caution, the overall outlook for Ethena appears promising. By keeping abreast of market trends, technological developments, and investor sentiment, stakeholders can make informed decisions that potentially capitalize on Ethena’s growth in the exciting world of cryptocurrency.